N26 vs Revolut le comparatif ultime

Banking Reviews N26 vs Revolut: Which Challenger Bank is the Best Fit for You? Two of the most prominent neobanks are N26 and Revolut, European fintech companies offering digital only apps, But which is Best? By Nicholas Say September 6, 2023

Revolut VS N26 ⇒ Quale Scegliere? Confronto e Differenze 2023

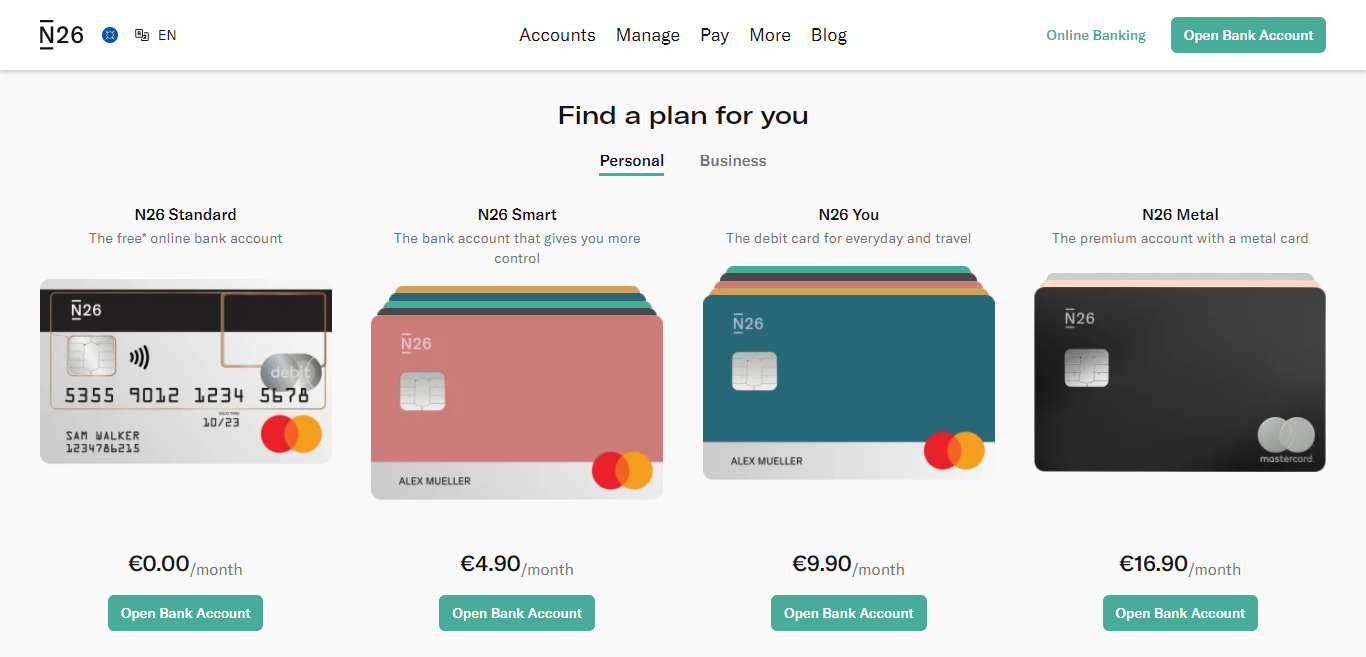

N26 Bank alternatives N26 vs Revolut. N26 Bank's closest competitor is Revolut, another European bank that is app-only and offers fee-free spending when abroad. N26 does however have a banking licence and although Revolut has had a banking licence approved, it is not yet able to operate as a fully-fledged bank.

Revolut vs N26 ¿Cuál es la mejor cuenta con tarjeta?

Go to Revolut The important bits Rates: N26 customers sending international transfers get the mid-market exchange rate. Revolut customers can get some currency exchange with the mid-market rate, although this may be capped for some account tiers Fees: Revolut and N26 both have either no-fee or fee paying accounts depending on the features you need

N26 vs Revolut (2023) The Battle of The Banks Platforms

N26 vs Revolut (2023): The Battle of The Banks Which Bank Best Suits Your Needs? If you subscribe to a service from a link on this page, Reeves and Sons Limited may earn a commission. See our ethics statement. Rosie Greaves Author 15 min Updated: May 1, 2023

N26 vs Revolut ¿Cuál es la mejor cuenta con tarjeta?

The N26 Black card costs a little more per year than the Revolut Premium, with a difference of € 36. While through the N26 card you have unlimited cash withdrawals, Revolut only allows you to withdraw € 400 per month without charging. When traveling, Revolut offers coverage that extends for 40 days.

N26 vs Revolut My 8Point Comparison (2023)

Quick Comparison On Trustpilot, Revolut has a rating of 4.3/5 based on 142k+ reviews, while N26 has a rating of 3.1/5 from 28k+ reviews. N26 is a solid choice for the convenient banking experience, while Revolut is an amazing option for travellers and open-banking enthusiasts.

Revolut Premium vs N26 You comparatif des cartes premium

August 5, 2020. Dubbed as "challenger banks" not that long ago, the digital banks N26 and Revolut have acquired over 15 million registered users (10 million for Revolut and 5.5 million for N26) as of the first quarter of this year, putting both on a hyper-growth track. They also dominated headlines when they raised huge funding rounds in.

N26 versus Revolut how do they compare? bonkers.ie

N26 uses a feature called CASH26, which lets you deposit anywhere between 50€ and 999€ within 24 hours and charges a 1.5% fee. On the other hand, Revolut doesn't charge fees when you deposit money into your account. N26 and Revolut have different withdrawal fee policies as well.

N26 Metal vs Revolut Metal Quale Scegliere? Costi, Limiti e Vantaggi

What is Revolut? Founded in 2015, Revolut is a fintech company which much like N26, is what is known as a digital bank. The platform specializes in a range of banking services - including systems for cheap currency exchange.

N26 vs Revolut ¿Cuál es la mejor cuenta con tarjeta?

N26 VS Revolut. Which is better? Both N26 and Revolut are regulated modern international mobile banks, with millions of customers in different countries and handy mobile apps. Check out which bank we think is best! n26.com. VS. revolut.com. Established. 2013. 2015. Trustpilot Rating. Excellent

Monzo vs Starling, Revolut and N26 The leading digital banks compared WIRED UK

Features Availability & Customer Reviews Bottom line: What's better, N26 or Revolut? Frequently Asked Questions What is N26? N26 is a neobank based in Germany, which holds a full European banking license. You can open an N26 account in mainland Europe, but unfortunately, N26 accounts are no longer available for new customers in the US or the UK.

N26 vs Revolut ¿Cuál es el mejor banco en diciembre 2023?

N26 vs Revolut: Which Is Better? N26 vs Revolut 8.3 Winner Monito Score Trust & Credibility 7.9 Service & Quality 8.0 Fees & Exchange Rates 9.3 Customer Satisfaction 8.1 Go to N26 vs 8.6 Monito Score Trust & Credibility 8.9 Service & Quality 7.9 Fees & Exchange Rates 8.3 Customer Satisfaction 9.4 Go to Revolut

💰N26 VS REVOLUT COMPARATIF, AVANTAGES ET AVIS DE BANQUES EN LIGNE FINTECH YouTube

Exchange Rates N26 uses the Mastercard exchange rate with zero mark-ups for all foreign transactions and ATM withdrawals while Revolut uses the Interbank exchange rate with a 1% markup at weekends.

N26 vs Revolut — Która karta jest lepsza? Która jest tańsza N26 czy Revolut?

Overview What is N26? N26 is a digital bank that was founded in Berlin, Germany in 2013. It operates entirely online and does not have physical branches. N26 offers a range of financial services, including online banking, debit cards, and currency exchange.

N26 vs Revolut Standard comparatif des cartes gratuites

Revolut vs N26 for frequent travelers Revolut. Revolut is a very good choice for anyone who travels a lot. This is because Revolut will not charge you on foreign exchange on all the major currencies for transactions not up to 1,000€ a month. For transactions more than 1,000€, a small 0.5% fee is charged.

Revolut vs N26 What is the best online bank for you?

Today I will be exposing the main relevant differences between 2 digital banking solutions, N26 and Revolut, because often I see people talking about both of.